The team here at CFC is committed to keeping our clients abreast of the latest and most pressing developments surrounding fire protection and life safety. In the face of COVID-19, Congress has taken numerous strides in extending a helping hand to American workers and small businesses that are the building blocks of our American economy.

On March 27, 2020, legislators passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Among a myriad of other provisions, there are now incentives to upgrade outdated, obsolete, and subpar fire and life safety systems at your commercial location with newly modified tax breaks and benefits.

What is the 2020 CARES Act?

Section 168 of the 2020 CARES Act stipulates that any improvement to the interior portion of a nonresidential or commercial property can qualify for an accelerated tax deduction at the full cost of those improvements. In other words, the value of your Qualified Improvement Property (QIP) can be fully deducted on your taxes in the year of its installment. This includes fire protection and life safety systems, and represents a valuable tool for business owners making important budgeting decisions regarding building improvements and investment.

There are a couple of restrictions to bear in mind. New construction does not qualify, and the act is retroactive only for costs incurred back to January 1, 2018. If your commercial or nonresidential property is not new construction, however, you have an opportunity to improve the safety and emergency response effectiveness of your business with the promise of significant financial relief.

The CARES Act in Action

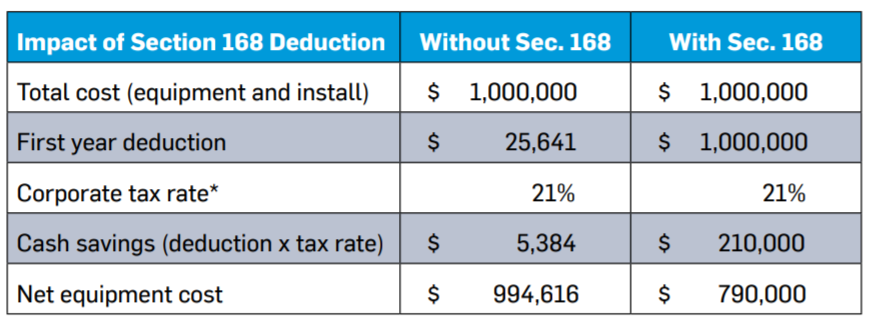

Before the 2020 CARES Act, the cost of a newly installed system was deducted throughout a predetermined 39-year period on your annual taxes. With Section 168 in place, the entire cost can be deducted in the first year of installation, which can lead to meaningful benefits. For example, say you invest $1,000,000 in the retrofit of your fire sprinkler system for your commercial building or property. You can write off that entire $1,000,000 as a business expense on that year’s taxes. Under earlier depreciation regulations, you’d write off a small fraction (1/39th assuming a 39-year depreciation schedule) of that total cost.

With the corporate tax rate of 21 percent and an investment of $1,000,000, you would save $210,000 and bring the net cost of the system (and cash outlay) down to $790,000. If this same investment were made under the pre-CARES Act policy, a business owner would only be able to deduct $25,641 in the first year and reduce the total first-year outlay for the equipment by $5,384.

A Final Word on the 2020 CARES Act From the CFC Team:

Consider investing in the continued safety and maintenance of your livelihood, customers and property while taking advantage of the accelerated tax deduction that the CARES Act offers.* Please contact CFC if we can be a resource for you.

*Contact your tax professional before making decisions that can affect your tax situation.